The world of investing often feels driven by logic and hard numbers. Yet, beneath this surface lies a complex terrain of emotions and cognitive biases that can lead even the most seasoned investors to make questionable choices. As the holiday season winds down and the New Year approaches, many embark on new financial resolutions, often plagued by the same emotional pitfalls. Understanding these patterns becomes vital now more than ever.

Understanding the Hidden Emotions of the Irrational Investor

Emotions such as fear, greed, and even the subtle rush of thrill from market fluctuations can significantly skew our judgment. As we dive into investment psychology, it’s crucial to recognize how these emotional undercurrents can dictate our stock decisions.

The Impact of Market Psychology

Many underestimate the power of behavioral finance, which studies the influence of psychological factors on investors. Those who have felt a pang of anxiousness while watching their stock portfolio dip can relate to this phenomenon.

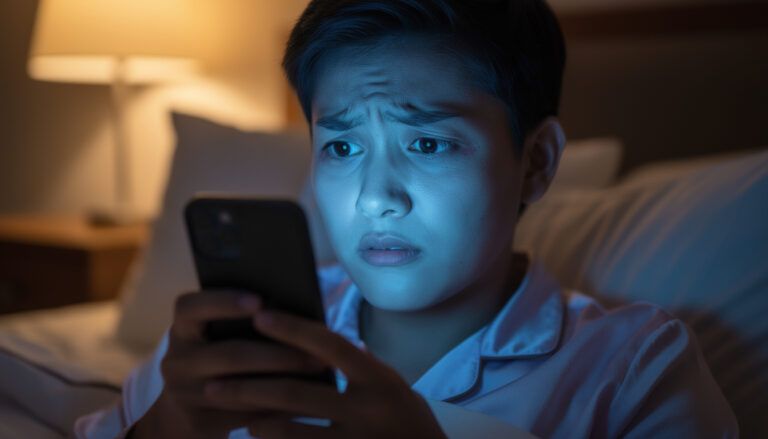

During the upcoming weeks, some investors might find themselves compelled to act impulsively due to a sudden market downturn. This behavior stems from the instinctive fear of loss. When faced with fluctuations, the brain triggers a fight-or-flight response, leading to hasty decisions.

Understanding this mechanism helps frame emotions accurately. The brain processes fear through the amygdala, heightening reactivity. While many recognize the logical aspects of investing, the emotional trigger points often go unnoticed, pushing individuals towards irrational moves.

Your temper problem isn’t you: The shocking mineral deficiency linked to sudden mood swings

- Recognize initial reactions to market changes: Are you feeling fear? Excitement?

- Pause before acting. Take a moment to assess your emotional state.

- Consult reliable data or a financial advisor for clarity.

Observe this pattern in your week! Are you finding yourself reacting more to market trends than making calculated decisions?

Exploring Emotional Investing

Absent a solid strategy, many become emotional investors, allowing feelings to steer their choices. This often leads to the regret bias: feeling trapped after missing a profitable stock or fearfully doubling down on a losing investment.

Consider Lisa, who, after hearing sensational news about a stock she owned, impulsively sold it, only to witness its meteoric rise shortly after. Reflecting back, she was influenced more by her emotions than by sound judgment and research.

What’s Happening in Your Brain When This Happens?

When faced with investment choices, individuals often hone in on losses more than gains—a phenomenon known as loss aversion. The brain’s neurochemical rewards kick in with gains but remain stagnant in the face of losses, creating an imbalanced view of risk. In this landscape, sharpening emotional awareness is essential.

- Keep a journal of your feelings before making significant investment decisions.

- Explore the motivation behind your investment choices—did you act on fear or informed analysis?

- Build a strategy that includes emotional checkpoints, which can support better decision-making.

Ask yourself: Are your emotions guiding your financial decisions, or are they merely temporary clouds obscuring your clearer judgment?

Mitigating Investment Mistakes through Self-Compassion

Wrapping oneself in self-compassion creates a cushion against the sting of investment missteps. Many irrational investors harbor overwhelming feelings of disappointment or shame; embracing failures can lead to profound learning experiences.

Empathy towards oneself provides a clearer lens through which to analyze financial choices. For instance, when reflecting on past decisions, instead of self-criticism, focus on extracted lessons. This practice builds resilience against future emotional pulls.

- Practice mindfulness to remain present in your decision-making processes.

- Engage in reflective exercises: What lessons have you learned from your past investment choices?

- Set emotional boundaries, allowing space for grief without letting it dictate your financial future.

As you navigate this, embrace missteps as stepping stones toward better strategies. What lessons do you find in your investment journey thus far?

Revisiting the Importance of Stress Management

Amid the hustle of New Year’s resolutions, managing stress is crucial for rational decision-making. Heightened anxiety can disrupt cognitive function, leading to potential pitfalls. Meltdown moments where investors react to stress by making quick trades often spell doom for portfolio longevity.

Stress creates a foggy lens, obstructing clarity needed for food decision-making. Remember that balance is essential in maintaining both emotional stability and financial sensibility.

Key Strategies to Implement

- Incorporate deep breathing exercises or yoga practices; these help lower stress and increase awareness.

- Limit news consumption and potential trigger points surrounding stock markets.

- Adopt a regular schedule for reviewing portfolios—this sets expectations and prepares for possible fluctuations.

Reflect on how stress impacts your decision-making frequency and clarity. How do your feelings correlate with market changes?

The Ripple Effect of Community and Dialogue

Connecting with fellow investors can enhance self-awareness and provide vital insights. Sharing emotions surrounding finances becomes a lifeline, helping individuals identify irrational behavior patterns they may otherwise overlook.

Investing shouldn’t feel like an isolated venture; dialogue fosters a deeper understanding of shared anxieties. Cognitive biases can blur vision, but engaging with others opens windows to clarity. You gain invaluable perspectives from experiences shared.

- Find investment groups or forums that foster open discussion.

- Share your experiences: How have emotions influenced your investment decisions?

- Analyze feedback from peers: How can their insights reshape your approach?

Are these connections providing fresh perspectives on your emotional investing journey? Multiply your insights in the next meet-up!

As we approach new horizons in financial journeys, patience is paramount. Growth unfolds at varied speeds, and every step—whether in missteps or leaps—crafts the larger narrative of our investing experiences. Embrace the lessons, and remember the importance of self-reflection as you march into the future with renewed confidence!