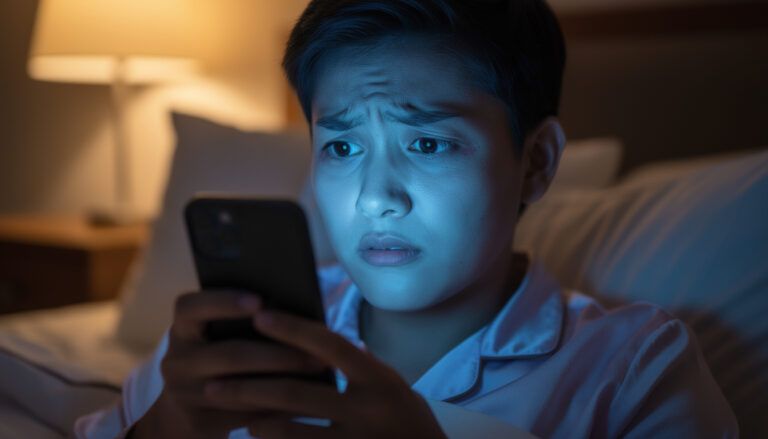

In the fast-paced world of cryptocurrency, the term “FOMO” or Fear of Missing Out has taken on a life of its own. As the calendar flips to December, many investors find themselves under pressure to make investment decisions, driven by the crowd’s enthusiasm and the fear of being left behind. This emotion isn’t just a lightweight concern; it can have profound implications for one’s financial health and emotional well-being. In these months of celebration and reflection, understanding crowd psychology around cryptocurrency can be a game-changer, informing smarter, more mindful investment choices.

Understanding FOMO in Altcoin Investments

The psychology of investment is fascinating and often fraught with contradictions. The primary driver of altcoin success in recent years has been a collective behavioral phenomenon—crowd psychology. This dynamic often results in challenging emotional highs and lows. Here, investors are not only faced with the reality of market trends but also the emotional tug of wanting to be part of the “in crowd.” Following others can lead to significant financial gains but can also devastate when the crowd’s enthusiasm fades.

The Allure of Herd Behavior 🐑

Herd behavior is a psychological concept where individuals look to the actions of others to inform their own behavior. In the context of cryptocurrency, this can lead to a steep increase in investing enthusiasm—driving altcoins to rapid highs. When seeing a social media frenzy over a new altcoin, individual investors can easily succumb to the belief that “everyone else is doing it, so I should too.” However, this can lead to a dangerous cycle of volatile investments and missed opportunities when market sentiment shifts.

- 🧠 Understand that herd behavior is often fueled by emotional decision-making.

- ✨ Recognize the difference between informed decision-making and impulsive reactions based on collective sentiment.

- 🧘♀️ Reflect on times you’ve felt compelled to follow others and the outcomes of those decisions.

Decoding Market Sentiment 💭

Market sentiment can be defined as the emotional tone of the investors within the cryptocurrency space. It fluctuates daily, influenced by external factors like news cycles, regulatory decisions, and major market shifts. Understanding the sentiment can help investors ground themselves amid speculative waves. Focusing on factual information instead of sensationalism can aid in maintaining a balanced perspective.

- 💡 Monitor reliable news sources to distinguish between hype and genuine trends.

- 📈 Evaluate investor behavior and its impact on price actions to better inform your strategies.

- 🤔 Reflect on how emotional reactions may have influenced your past investment choices.

The Role of Emotional Resilience 💪

Emotional resilience is a crucial trait for navigating the erratic waters of cryptocurrency investments. When investors become desensitized to fluctuation, they are more likely to think critically and resist following the crowd blindly. Encouraging a mindset of patience and thoughtful reflection allows for more measured responses during downturns or peaks.

The chaos hormone: The scientific link between visual clutter and elevated body stress levels

- 🌱 Practice self-compassion during turbulent market periods to maintain emotional health.

- 🔄 Reframe setbacks as learning experiences rather than failures.

- 🧩 Observe your emotional responses during significant market movements—awareness is key!

Combatting FOMO: The Power of Independent Research 📚

Conducting independent research is foundational for anyone involved in cryptocurrency investing. Knowledge is a powerful antidote to FOMO. Investors are encouraged to reach out beyond mainstream narratives, looking for insights from both the proponents and critics of various altcoins. This balanced approach can inform not just if they’ll join a trend, but why they might choose to invest in a particular asset.

- 🔍 Research diverse viewpoints about each cryptocurrency to form a rounded perspective.

- 💬 Engage in discussions with seasoned investors to expand your knowledge base.

- 📝 Maintain a journal of your thoughts and organized research to bolster informed decision-making.

Final Thoughts: Embracing a Thoughtful Approach 🚀

As 2025 unfolds, the landscape of cryptocurrency investment will continue to evolve. It’s important to remember that patience and independent thinking are invaluable assets. Being mindful of the emotional aspects of investing can enable individuals to make better decisions. The tendency to follow the crowd may be gut instinct, but through self-awareness and research, investors can pave their own paths in the exhilarating world of altcoins.